The CFA Institute reports that Chartered Financial Analysts earn an average of $180,000 a year. But naturally, the Institute has a lot to gain by convincing you to join the ranks of a global army of CFAs, and data like that isn’t always easy to trust.

For an alternative perspective, look to Reddit, where you may find a multi-paragraph tirade on how earning a CFA® charter hasn’t gotten the original poster to the place they want to be.

The last thing you want is to commit to something that doesn’t pay off, and you have a massive decision ahead of you. In this guide, I’ll break down the real benefits of earning a CFA® certification, from salary potential to job growth opportunities, so you can decide if it’s the right path for you.

No fluff; all facts. Let’s dive in.

Key Takeaways

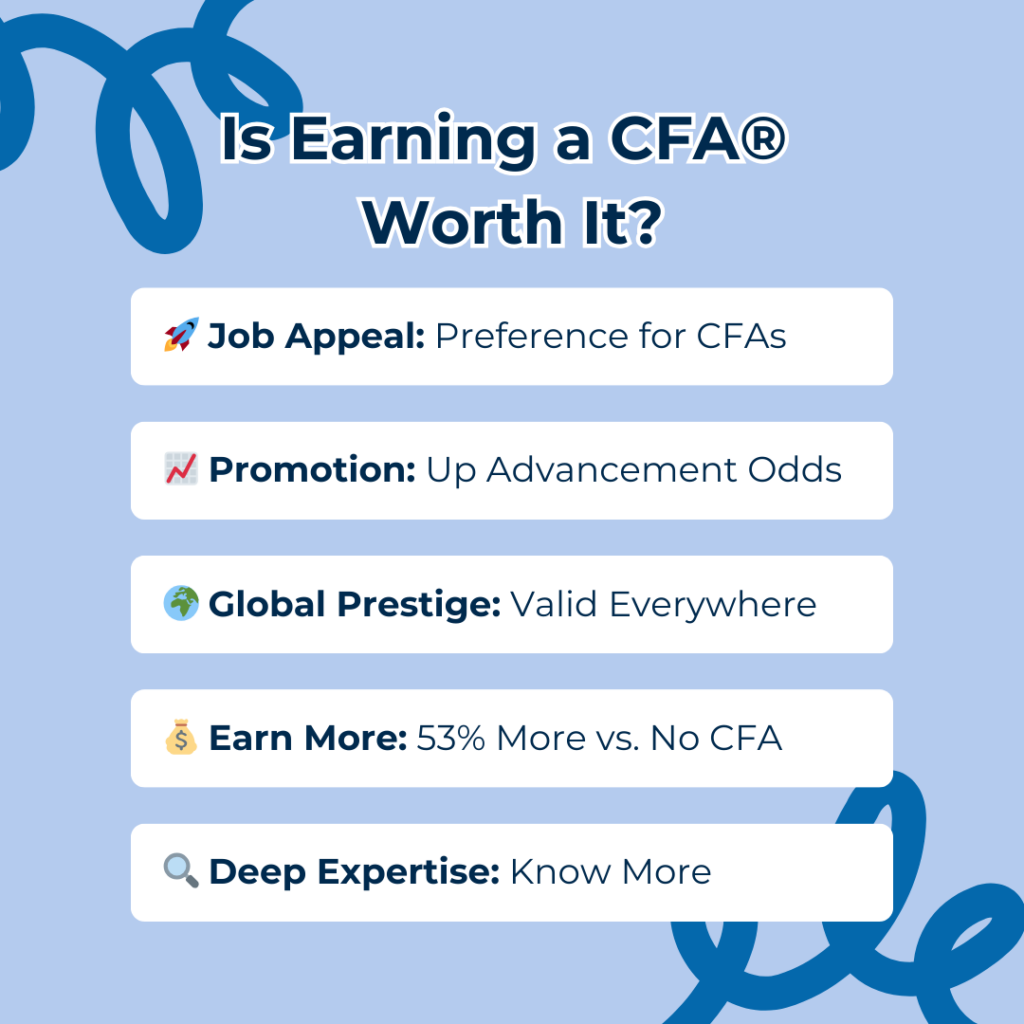

- Higher Earning Potential: CFA® charterholders earn an average of 53% more than their non-certified peers, making it a powerful investment in your career.

- Global Recognition: Unlike other finance certifications, the CFA® designation holds worldwide respect, opening doors to opportunities in international finance.

- Diverse Career Paths: CFAs work in investment management, portfolio management, corporate finance, risk analysis, and financial advisory, giving you flexibility in your career.

- Strong Job Market Demand: Many investment firms, hedge funds, and financial institutions prefer or require CFA® certification for senior roles.

- Challenging but Rewarding: The CFA® exam is notoriously tricky, but passing it sets you apart as a top-tier finance professional with advanced analytical skills.

What Is the CFA® and Who Is It For?

For aspiring Chartered Financial Analysts, CFA® charterholder status is the ultimate goal. This designation is designed for finance professionals who specialize in investment management, portfolio management, and financial analysis. It’s a globally-recognized certification for finance professionals.

This certification can be a game-changer if you dream of working in hedge funds, asset management, private equity, or investment banking. But is it right for you?

Who Should Consider the CFA® Program?

The CFA® program isn’t for everyone. It’s a grueling multi-year commitment but pays off big for the right people. You should consider it if you:

- Love finance and investing – You enjoy analyzing markets, assessing risk, and making investment decisions.

- Want to boost your career – You’re looking for promotions, job offers, and salary increases in finance.

- Have strong analytical skills – CFAs excel at interpreting financial statements, using quantitative methods, and making data-driven decisions.

- Value global recognition – The CFA® is respected worldwide, making it a great choice for candidates eyeing international finance roles.

- Are ready for the challenge – The CFA® exam is known for being one of the toughest in finance, requiring dedication and discipline.

CFA® Salary: How Much Can You Earn?

Let’s talk about what everyone really wants to know: How much does a CFA® make?

According to the CFA Institute, CFA® charterholders earn 53% more on average than non-charterholders in similar roles. Of course, salaries vary based on experience, location, and job title. While I think this number is likely a bit inflated, I wouldn’t be surprised if you could still look forward to a 20% or higher increase.

Here are some of the job titles, salary ranges, and average salaries you can look forward to upon earning your charter:

CFA® Salary Estimates by Role

| Title | Range | Average |

|---|---|---|

| Investment Analyst | $65,000 – $130,000+ | $85,000 |

| Portfolio Manager | $65,000 – $180,000+ | $100,000 |

| Financial Advisor | $75,000 – $140,000+ | $100,000 |

| Corporate Finance Analyst | $70,000 – $250,000+ | $105,000 |

| Chief Investment Officer | $110,000 – $250,000+ | $150,000 |

The biggest salary jumps occur when you combine experience with the CFA® designation, which is why many professionals pursue it as a long-term investment in their careers.

Is the CFA® Certification Worth It for Career Growth?

Absolutely. The CFA® designation isn’t just a resume booster—it’s a powerful career accelerator.

Here’s how it opens doors in the financial industry:

🚀 Job Market Advantage: Many investment firms prefer or require CFA® certification for senior roles.

📈 Promotion Potential: A CFA® can fast-track you to leadership roles if you’re already in a finance career.

🌍 Global Recognition: Unlike some country-specific finance certifications, the CFA® offers the same prestige around the globe.

💰 Higher Earning Power: CFAs consistently earn higher salaries than their non-certified peers, with up to 53% higher estimates.

🔍 Deeper Expertise: The CFA® program covers financial reporting, corporate finance, ethics, and investment analysis, making you an expert in the field.

If you want to stand out in finance, the CFA® charter is one of the best investments you can make in your career.

Is the CFA® Worth It: From the Experts

It’s one thing for me to tell you that a CFA® is worthwhile; however, it’s better to hear some experiences directly from the mouths of the people in CFA® positions:

Hard Work, High Reward

“Like all things in life, it’s entirely up to you to leverage the CFA into a career. It’s not going to just be handed to you the moment you get a charter, which appears to be the expectation here. Networking, social skills, relevant experience, and of course, gumption all need to be in place as well.

I got into portfolio management post CFA AND MsF, almost immediately doubled my salary despite still a junior on the desk. First job application. Now in top 10% of earners and will be in top 5% in a few years the way things are going.

Tried a dozen times before completing CFA, got an interview once that didn’t go anywhere. Nearly every other PM on our floor has a CFA. Those who don’t have masters or doctorate degrees. Is it 100% directly applicable? No. Is it completely irrelevant? Anyone who tells you that is a shill pushing their own agenda (which isn’t to help you).” – (u/B4SSF4C3)

Promotions and Greater Authority for Consultants

“As a CFA charter holder, I’ve thought about this. I haven’t been rocketed forward in my career because of it like I imagined at first, but it has certainly helped. I’m a consultant and I’ve been promoted, consistently staffed and brought into projects that I otherwise wouldn’t have been.

There’s a nice level of prestige to it for sure. People see it on your LinkedIn and email signature, and it’s quite nice when it is brought up in conversation to be able to say that you’ve passed all 3.

It has given me a much better understanding of all manner of financial products, the risks associated, and though I’ve “forgotten” much of what I learned, I can revisit a topic if needed and it comes back quickly.

I’ll just say this – the time is going to pass whether you’re studying or not. If you think those nights are better spent relaxing, exercising, being with family, or whatever you’d prefer to be doing, then that’s your call. I am proud of the work I put in, and my parents are proud of me for doing it – my friends and family are proud of me for doing it. I learned a lot. That’s a pretty good deal, but I understand if it’s not worth it for you personally.” (u/MaraudngBChestedRojo)

Increased Pay and Influence

“I work in portfolio management and passing level 1 last year immediately boosted my total compensation immensely and my career prospects within the firm. Every single PM has it for my office, and they suddenly notice everything I do now.” (u/sockmasterrr)

How Hard Is the CFA® Exam?

Let’s be honest—the CFA® exam is brutal.

It consists of three levels, each covering different aspects of finance:

CFA® Exam Structure

- Level I: Ethical and professional standards, quantitative methods, and financial reporting.

- Level II: Investment analysis, equity investments, and portfolio management.

- Level III: Advanced portfolio management and wealth planning.

Each level requires an average of 300+ hours of study, and only about 40-50% of candidates pass each level.

But the good news? A solid CFA® exam prep course can make all the difference.

Is the CFA® Program Right for You?

Here’s a quick way to decide:

- You should pursue the CFA® if…

- You want a finance career with high salary potential.

- You’re willing to put in the time and effort to pass the CFA® exam.

- You enjoy investment analysis, portfolio management, and financial strategy.

- You might want to reconsider if…

- You’re not interested in investment management or corporate finance.

- You prefer a faster certification like the CFP or CMA.

- You don’t have 300+ hours per level to dedicate to studying.

Final Verdict: Is the CFA® Worth It?

If you’re serious about a long-term finance career, the CFA® is 100% worth it.

It’s challenging, but the salary benefits, job market advantages, and global recognition make it a wise investment for anyone looking to excel in investment management, corporate finance, or financial analysis.

If you’re ready to take the leap, the first step is to study for the CFA® exam with a top-rated prep course. With the right strategy, you’ll be on your way to earning one of the most respected credentials in finance—and unlocking incredible career opportunities.

Good luck on your CFA® journey!

FAQs

A CFA® boosts your career prospects, salary, and credibility in finance. It’s highly valued in investment management, portfolio management, and corporate finance.

A CFA® is ideal for finance and investing, while an MBA covers broader business topics. If you want to specialize in investment management, the CFA® is the better choice.

The CFA® exam has three levels, takes years to complete, and has lower pass rates (40-50%). The CPA exam is challenging but more structured, focusing on accounting. Check my comparison of the CFA® vs CPA to see which exam and career is for you.

CFAs are experts in investment analysis, risk management, and portfolio strategy. Their deep financial knowledge makes them valuable in high-level finance roles.

Yes! CFA® charterholders earn 53% more on average than non-certified financial professionals, with six-figure salaries typical in investment firms and financial institutions.