Let’s be real: a lot of BNPL services sound too good to be true. Pay in four, no interest, so you get to stretch every paycheck… where’s the catch? And with Sezzle reporting revenue growth of 67% via their latest quarterly report, it’s natural to wonder:

Is Sezzle safe to use?

With so many stories about online scams and credit trouble, let’s clear things up so you can shop with your eyes wide open (and feel confident while you do it).

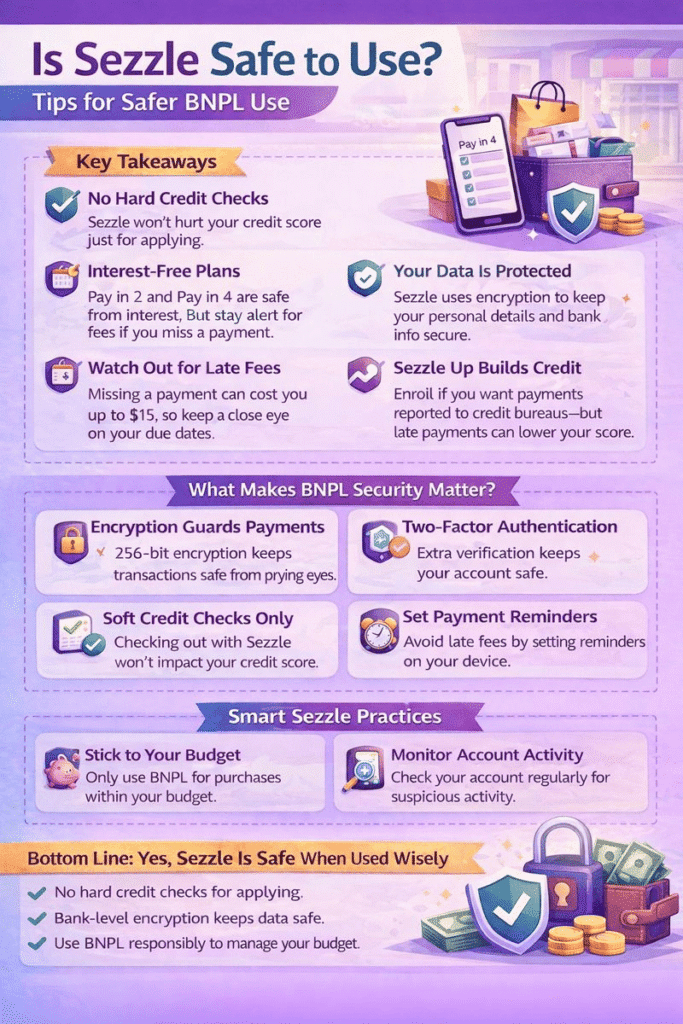

Key Takeaways

- No Hard Credit Checks: Sezzle won’t hurt your credit score just for applying.

- Interest-Free Plans: Pay in 2 and Pay in 4 are safe from interest, but stay alert for fees if you miss a payment.

- Your Data Is Protected: Sezzle uses encryption to keep your personal details and bank info secure.

- Watch Out for Late Fees: Missing a payment can cost you up to $15, so keep a close eye on your due dates.

- Sezzle Up Builds Credit: Enroll if you want payments reported to credit bureaus—but late payments can lower your score.

What Is Sezzle—And Why Should You Even Care About Safety?

Picture this: You spot the perfect pair of shoes online. Your budget is tight this month, but the “Pay in 4, no interest!” button is calling your name. That’s Sezzle in a nutshell.

Sezzle lets you break your purchase into four or five smaller, interest-free payments. No banks, no credit cards, no waiting. Handy, right?

But here’s where it gets real: You’re handing over personal and payment info to a company you might not know. So, is Sezzle safe to use, or are you risking more than a new pair of kicks?

The Tech Stuff: How Does Sezzle Keep Your Money and Info Safe?

Worried about hackers grabbing your credit card number? Here’s the scoop:

- Sezzle locks down your transaction with 256-bit SSL encryption—the same kind banks use.

- Your actual card info? It never goes to the retailer. That bit stays between you and Sezzle.

- They only work with payment processors who are PCI DSS compliant. (That’s finance-speak for super secure.)

- They throw in two-factor authentication (2FA) and sniff out fraud fast.

So, even though nothing online is totally bulletproof, Sezzle brings solid tech to the table to keep your details out of the wrong hands.

Does Sezzle Hurt Your Credit Score?

Let’s get transparent. A regular Sezzle account means just a soft credit check—the kind that does not show up on your credit report and won’t ding your score.

But what if you want to up your game and raise your credit? Sezzle Up is an opt-in that reports payments to the major agencies. Paying on time helps; missing payments hurts.

Hot tip: If you stick to the standard account, missing a payment won’t touch your credit score. But if you use Sezzle Up, set reminders! Irresponsible use will show up on your credit history, just like a missed credit card bill.

What If You Miss a Payment? Let’s Talk About Fees

Here’s the part they don’t always say upfront: Sezzle doesn’t charge interest, but miss a payment and you’ll face late fees (up to $15 each time) plus a frozen account.

You can reschedule a payment once for free—handy if payday is coming late—but do it too many times or go silent, and things get more expensive.

If your payments stay overdue, in rare cases, Sezzle might send your account to collections. (Nobody wants that knock on the door.)

And be careful: The biggest hidden risk is sneaky overspending. Those small payments can add up if you’re not tracking your budget.

What Happens to Your Data? Sezzle and Your Privacy

Worried about someone selling your data to advertisers? Here’s the good news: Sezzle says they collect the basics—your name, contact info, card details, and shopping history—mainly to prevent fraud and run their service.

They don’t sell your personal details to third parties. Only trusted partners get access, like payment processors or, if required, the law.

Of course, this is the internet, so smart shoppers use strong passwords and keep an eye out for weird activity, just in case. If you’re curious or cautious, Sezzle has a privacy policy you can scan and tweak your settings as needed.

How Do You Actually Use Sezzle Safely? Real-World Best Practices

Want to use Sezzle and skip the stress? Here’s what your savvy friend would tell you:

- Stick to your budget. Only use Sezzle for what you can truly afford.

- Never miss a payment. Set phone reminders or go with autopay if that’s your style.

- Check your account often. See something off? Act fast.

- Lock down your login. Use a password you haven’t used anywhere else. Turn on 2FA if possible.

- Read their rules. Take a look at Sezzle’s privacy policy and update your data preferences.

All this takes five minutes, but saves you a ton of hassle later.

Bottom Line: Is Sezzle Safe?

So, is Sezzle safe to use? If you’re careful and stay on top of things, absolutely. They use strong security. They’re transparent about credit. Their privacy policies are clear.

But remember: Even the best tech can’t protect you from impulse buys or missed payments. If you follow the basics—budget wisely, pay on time, and guard your details—Sezzle can be a super helpful way to pay over time.

No financial service is perfect, but Sezzle stacks up well for privacy-minded, budget-conscious shoppers who want some breathing room on payments. Stick to the plan, and you’ll be just fine.

FAQs

No, Sezzle only does a soft credit pull, so your credit score won’t be affected just for applying.

Not unless you enroll in Sezzle Up, which reports on-time and late payments to credit bureaus.

Yes, Sezzle uses bank-level encryption and doesn’t share your sensitive data with retailers.

You might pay up to a $15 late fee, and if you’re in Sezzle Up, a missed payment could show up on your credit report.

You can use Sezzle at partner stores and anywhere Visa is accepted if you have the Sezzle Virtual Card.