If you’re anything like me, the idea of buy now, pay later services can make you feel a little apprehensive. After all, paying less upfront and spreading out payments over time at no additional cost to the spender can feel too good to be true.

Pretty quickly, the question becomes: how does Sezzle work?

I’ve used it quite a few times myself, and, luckily, it’s a lot simpler (and less sketchy) than you might think. So, let’s break it down, covering how it works, what exactly it does, and how it benefits both consumers and the company behind the tool.

Key Takeaways

- Simple Payment Splitting: Sezzle divides purchases into four interest-free payments, making it easy to manage short-term expenses.

- Soft Credit Check Only: Approval doesn’t impact your credit score, though missed payments may have consequences if you opt into credit reporting.

- Multiple Payment Options: Users can link a debit or credit card or a bank account directly for automatic payments.

- Revenue Comes from Merchants: Sezzle earns money through merchant fees, select service fees, and longer-term financing options.

- Ideal for Responsible Users: Sezzle is most effective when payments are made on time and missed payments can trigger fees or denied access later.

Sezzle for Consumers: What Happens, Step by Step

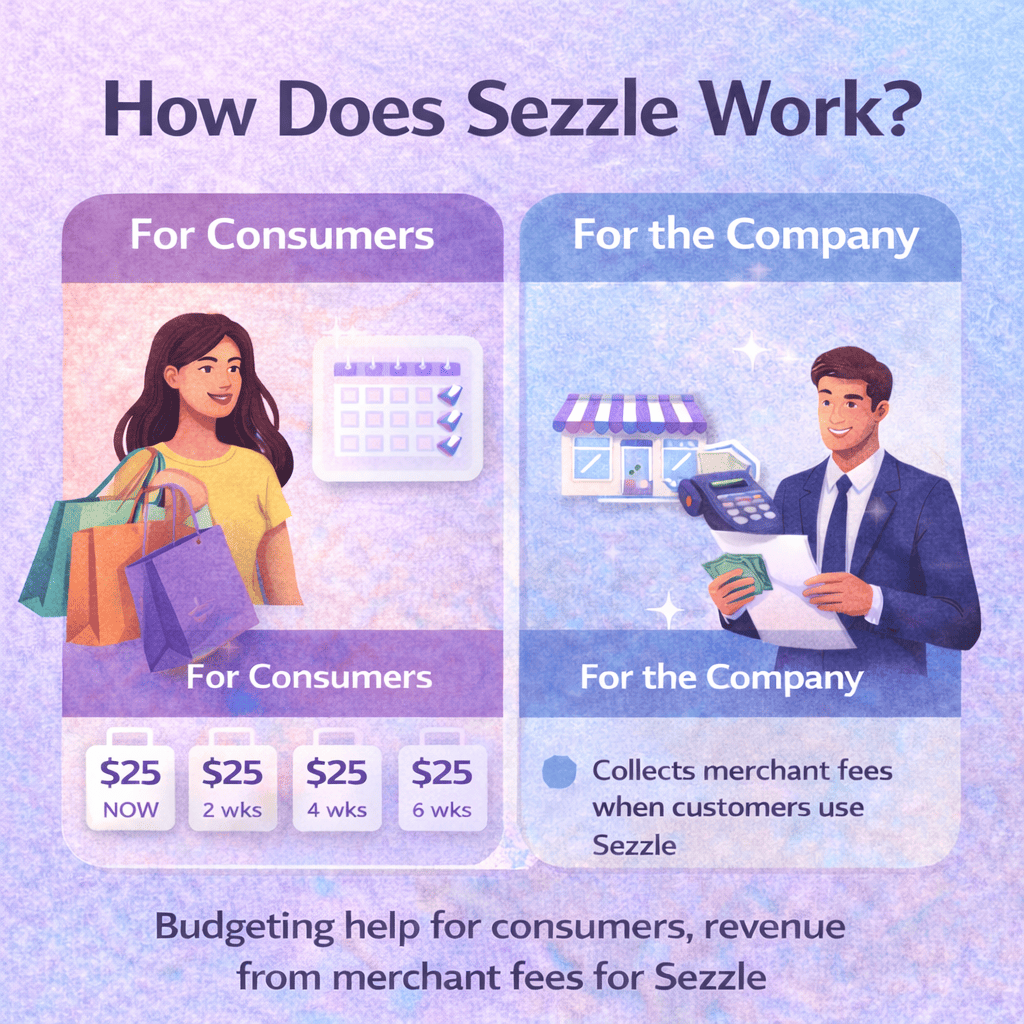

At its core, Sezzle gives shoppers the option to split a purchase into four interest-free payments instead of paying the full purchase price upfront. The idea is to make everyday buys more manageable without racking up interest or revolving debt.

Here’s what typically happens when you use Sezzle:

- Choose Sezzle at Checkout: When you’re ready to buy, you select Sezzle as your payment option. This works in stores that support Sezzle and through a Sezzle virtual card for sites that don’t have it built in.

- Open or Log In to Your Sezzle Account: If you’re new, you’ll create a Sezzle account. That usually requires a valid phone number, email, and a preferred payment method like a bank account or debit/credit card.

- Soft Credit Check: Sezzle performs a soft credit check to determine your eligibility. This doesn’t affect your credit score and won’t show up on your credit report.

- First Payment at Checkout: You pay the first 25% of the purchase price at the time of checkout. The rest—the remaining payments—are scheduled automatically.

- Equal Installments Over Time: The remaining amount is then charged in equal installments over the next few weeks, usually in four payments spaced over six weeks.

- Automatic Payment Attempts: Sezzle charges whichever payment method you set up on the dates in your schedule. All of this is managed through the Sezzle app, where you can see your upcoming payments and balances.

- Notifications and Management: Before each due date, Sezzle will notify you so you know when a charge is coming. You can also reschedule once per order if you need flexibility.

Sezzle also offers a “Pay Monthly” option for larger purchases, where you make monthly payments over a longer period—and this option may include interest, depending on your terms.

What Happens If Something Goes Wrong?

Sezzle’s flexibility is a big draw, but there are a few pitfalls users should understand:

- Missed payments can result in late fees and affect your future approval chances.

- If there are insufficient funds or your card is declined, you could incur a processing fee.

- While Sezzle generally doesn’t do hard credit checks, missed payments might be included in your payment history reporting if you enroll in optional credit tools.

The service isn’t designed to trap you with high interest, but it does need you to stay on top of your schedule. That’s especially true if you use the Sezzle virtual card for purchases where pushback from banks may trigger delays or declines.

How Sezzle Works for the Company

Understanding how Sezzle works from the business side gives you insight into why the service feels “free” but still makes financial sense as a company.

Here’s how Sezzle earns and operates:

- Merchant Fees: Sezzle charges fees to the stores and sellers that offer it at checkout. These fees help the company stay profitable while letting you pay in smaller chunks.

- Risk Management: Sezzle assumes the risk of nonpayment. It uses its own underwriting model (the soft credit check and internal scoring) to decide who gets approved and for how much.

- Service and Processing Fees: While the consumer experience can be interest-free, Sezzle does earn from certain fees—like processing fees on virtual cards or service fees when applicable.

- Returns and Refunds: If you return a product bought with Sezzle, the company adjusts your payment schedule and may refund amounts already paid.

Unlike traditional lenders, Sezzle doesn’t directly make money from interest charges on short-term BNPL plans, which is why it focuses so heavily on repeat usage, merchant relationships, and user growth.

Responsibilities for Users

From your side, it helps to think of Sezzle as a simplified term loan broken into equal parts without the interest baggage, as long as you follow the plan. This means:

- Make sure you have a payment method ready (bank account or card).

- Monitor your outstanding balances to ensure that payments clear.

- Avoid repeated missed payments, which can lead to fees and potentially impact your access to future BNPL plans.

- Use the app to see your remaining amount and upcoming installment dates.

Staying organized is especially important if you also use other financial products like traditional credit cards and installment loans.

Sezzle vs. Traditional Credit Tools

Sezzle’s user experience and fee structure set it apart from traditional lending tools:

- With a credit card, you get a billing cycle, a credit limit, and potentially interest charges if you carry a balance.

- With Sezzle, there’s no revolving balance or long-term credit line—just a fixed schedule of payments.

- Your credit bureaus’ reporting behavior also differs: credit cards frequently appear on credit reports, while Sezzle does so only if you opt into their reporting tools.

Some people prefer Sezzle’s clarity and fixed schedule because it’s easier to budget for four interest-free payments than a revolving card balance that can balloon with interest and fees.

Why People Use Sezzle

Sezzle customers often choose it for a few reasons:

- Budget management: Paying in chunks helps smooth out cash flow without incurring interest.

- No hard credit checks: Access is easier for people with limited credit history or a low score.

- Flexible repayment: The app’s interface and notifications make it easy to stay on top of payments.

- Short-term peace of mind: Knowing the total amount due upfront helps prevent surprises.

These elements combine to make Sezzle feel more predictable than some traditional credit tools—but the tradeoff is that it’s not a long-term credit building solution unless you opt into credit reporting.

Wrapping Up

So how does Sezzle work? For many shoppers, it’s a legitimate and useful alternative to paying interest or using a credit card, especially for smaller purchases. It doesn’t perform hard credit checks, spreads cost over time with multiple payments, and gives you visibility into your payment schedule.

For Sezzle as a company, it’s a business built around advancing funds, managing risk, and collecting payments reliably—all while keeping the customer experience smooth.

All in all, if you know what you’re getting into and plan ahead, it’s a very safe and effective solution to age-old cash-flow woes. To learn more about Sezzle, check out their website here.

FAQs

Sezzle lets shoppers pay 25% of the purchase upfront and the rest in three equal, interest-free installments over six weeks.

No. Sezzle uses only a soft credit check during signup, so applying won’t affect your credit score.

Only if you enroll in Sezzle Up. If you do, payment activity can be reported to credit bureaus, which can help or hurt your credit depending on your behavior.

You can connect a debit or credit card, or link your bank account directly as your default payment method.

Sezzle earns revenue through merchant fees, processing fees, and interest-bearing monthly payment plans for higher-cost purchases.