With more shoppers looking for ways to spread out their spending, Buy Now, Pay Later services are booming. One name that keeps popping up is Sezzle.

But if you’re cautious about your finances, it’s fair to ask: Is Sezzle legit?

Well, I’ve used it myself to help offset the immediate impact of pet care bills, tech buys, and even vacations.

In this article, we’ll take a deeper look into how Sezzle works, its pros and cons, how it stacks up against traditional credit tools, and whether you can trust it with your purchases and personal information.

Key Takeaways

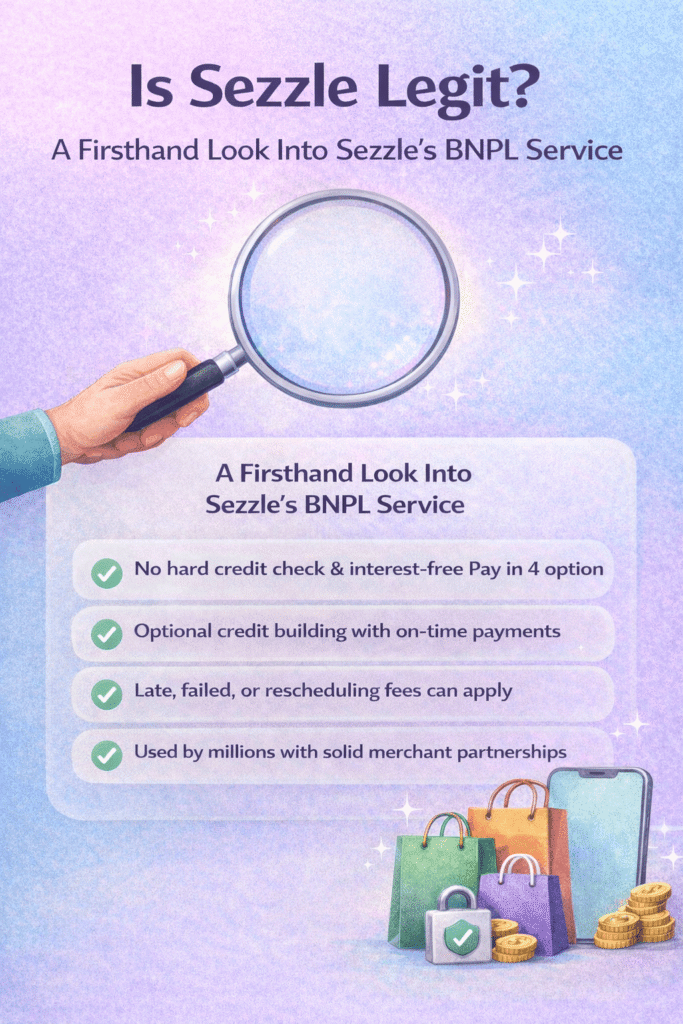

- Legit and Trusted: Sezzle is a legitimate BNPL platform used by millions for interest-free, short-term payment plans.

- No Hard Credit Check: Signing up won’t affect your credit score, but missed payments could if enrolled in credit reporting.

- Optional Credit Reporting: With Sezzle Up, payment history is shared with major credit bureaus to help build credit history.

- Fees Can Add Up: While interest-free, Sezzle may charge late, failed, or rescheduling fees if you miss due dates.

- Great for Budgeting: Ideal for short-term, fixed payments without the risks of long-term credit card debt.

What Is Sezzle, and How Does It Work?

Sezzle is a Buy Now, Pay Later (BNPL) platform that lets users break up their online or in-store purchases into interest-free payments, typically over six weeks. It’s best known for its Pay in 4 plan, where you pay 25% upfront (initial payment), and the remaining payments are spread out across three additional biweekly payments.

All of this happens through the Sezzle app, where you manage your Sezzle account, schedule payments, track your orders, and—if needed—reschedule your due dates. Users can link a bank account or debit card as their default payment method, and Sezzle automatically withdraws payments based on the repayment schedule.

What Makes Sezzle Stand Out?

Sezzle appeals to consumers with its simple setup and flexible approach. There’s no hard credit check to sign up, only a soft credit check, which never affects your credit score. This makes it accessible for those with a low credit score or limited credit history.

In addition, Sezzle provides an upgrade path via Sezzle Up, a feature that enables credit reporting to major credit bureaus like Experian, Equifax, and TransUnion. When enrolled, your payment history is shared, meaning on-time payments can help build a positive credit history over time.

Sezzle’s Core Payment Options

| Plan Type | Description | Interest |

|---|---|---|

| Pay in 4 | Four biweekly payments over six weeks | No |

| Pay Monthly | Monthly payments over a longer term | Yes (interest varies) |

Pay in 4 is Sezzle’s default offering and is the most popular. It is designed for smaller purchases you can manage in a short timeframe. For larger purchases, Pay Monthly provides a more traditional BNPL loan structure, where interest rates apply, similar to a personal loan or credit card.

What Are the Fees?

While interest-free payment plans are a key draw, Sezzle does have fees—especially if you’re not staying on track:

- Late payment fees: Up to $15 for missed due dates

- Failed payment fees: Up to $5 if your payment method fails

- Payment rescheduling fee: One free reschedule per order; fees apply after that

- Service fee: May apply to single-use virtual cards or certain merchant transactions

These payment fees are relatively reasonable, but they can add up quickly, especially if you rely on Sezzle regularly and run into missed payments or need frequent adjustments.

Is Sezzle Safe?

From a security standpoint, yes—Sezzle operates with encrypted payments and adheres to data protection standards. Your financial obligations are clearly laid out in the Sezzle app, and you receive alerts before each payment is charged.

In terms of legitimacy, Sezzle is a publicly trusted brand with millions of users and merchant partners. It’s not a scam, and your money doesn’t “disappear.” However, just like any BNPL service, it can become risky if you don’t manage your installment payments wisely.

Real User Experience

The Sezzle app is easy to use, well-reviewed, and packed with practical features like:

- Tracking your payment plan and due dates

- Viewing upcoming Sezzle payments

- Rescheduling payments (with some limits)

- Accessing support for billing or merchant issues

Sezzle Premium also exists for those who want perks like higher spending limits and access to exclusive retailers. However, it comes with a monthly fee, so it’s only worth it if you’re using Sezzle often.

Here are some testimonials from real users:

“It doesn’t ask for ID but you will need a valid phone number to verify a code and you will need a valid debit card and you will have to provide your social security number. I’ve already made 3 different purchases on Sezzle and everything is smooth and I may turn on the Sezzle up feature to get positive points towards my credit and see how that goes.”

“I used it, no ID required. Easy checkout, no issues so far.”

“Hi if I remember correctly, they ask for your home address only when signing up. No IDis needed. You also have the option to get Sezzle Up which will ask for your social security to help with your credit when you make payments. But, it is optional. And yes you have to pay for the premium option. It’s pretty good since it allows you to use your Sezzle virtual card in some stores like Target which is nice. After a while you can upgrade to Anywhere. It lets you use your virtual card anywhere they accept Apple/google pay like restaurants and stores and even gas stations.”

When Sezzle Works Well—and When It Doesn’t

Use Sezzle if you:

- Want to break up smaller purchases into four no-interest payments

- Need flexible financing without using a credit card

- Want to build a positive credit history (via Sezzle Up)

- Prefer to manage your spending with defined, short-term plans

Avoid Sezzle if you:

- Tend to miss payments or overspend

- Already struggle with managing multiple debts

Final Verdict: Is Sezzle Legit?

So, as someone who’s used Sezzle, I believe it’s a 100% legit buy now, pay later service. It’s a reliable, well-established BNPL platform offering clear payment plans, optional credit reporting, and a user-friendly app experience. It’s not a scam, not a trap, and not out to trick you with hidden costs. As long as you stay organized and make your payments on time, it is a solid solution. That said, it’s not a substitute for smart financial habits. Like all BNPL services, Sezzle gives you convenience—but you’ll need to be disciplined to truly reap the benefits.

Interested in learning more? Check out Sezzle in more depth right here.

FAQs

Yes, for Pay in 4 plans. Sezzle does not charge interest on short-term purchases as long as payments are made on time.

Not by default. Sezzle uses a soft credit check and only reports to credit bureaus if you enroll in Sezzle Up.

Sezzle may charge late payment fees, failed payment fees, and rescheduling fees if you adjust your payment schedule after the free limit.

It depends. Sezzle avoids revolving debt but offers fewer protections and no rewards compared to traditional credit cards.

Yes, but only if you opt into Sezzle Up. Consistently paying on time through Sezzle Up can help strengthen your credit by adding positive activity to your credit reports.